Mileage rates are more important than they might seem, impacting both personal and professional financial planning. Whether you're a independent contractor claiming tax deductions or a entrepreneur reimbursing employees, understanding these rates is essential for accurate expense management.

### Understanding Mileage Rates

Miles Rates are preset amounts that the IRS allows for the cost of operating a vehicle for business purposes. These rates are updated annually to reflect fluctuations in fuel prices, maintenance costs, and other relevant factors.

### Why are Mileage Rates Important?

- **Tax Deductions:** People and companies can deduct mileage expenses from their tax base, notably reducing their tax liability.

- **Fair Compensation for Employees:** Employers can reimburse employees for business-related travel expenses using the standard mileage rate, guaranteeing fair compensation.

- **Organized Cost Management:** Mileage rates provide a uniform method for tracking and reporting transportation costs, simplifying expense management.

- **Budgeting and Forecasting:** By understanding mileage rates, people and companies can plan more effectively for travel expenses and make informed decisions about travel plans.

### How to Use Mileage Rates

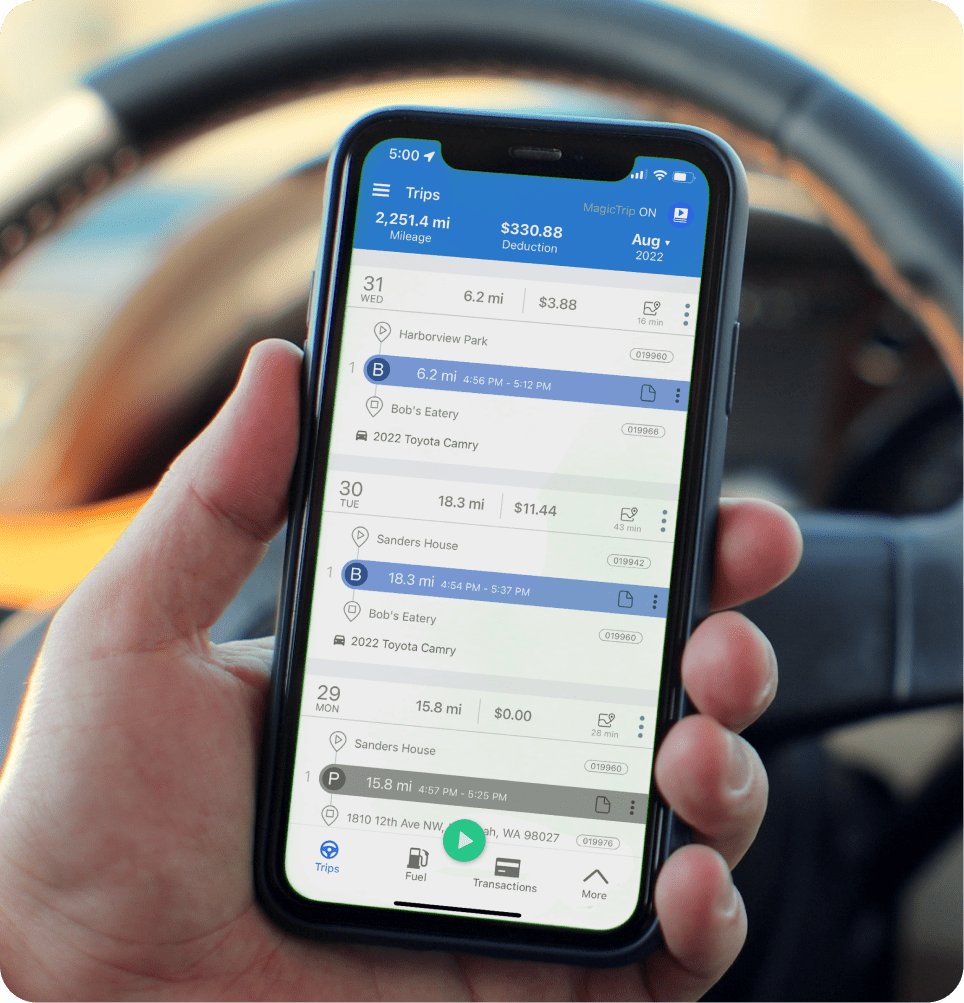

1. **Identify Work-Related Travel:** Precisely track the business miles driven for each trip.

2. **Apply the Standard Rate:** Multiply the overall business miles by the current standard mileage rate set by the IRS.

3. **Maintain Accurate Records:** Maintain detailed records of all business trips, including dates, starting and ending points, and the reason of each trip.

4. **Use Current Rates:** The IRS updates the standard mileage rate yearly, so ensure you are using the latest rate for your tax year.

### Beyond the IRS Standard

While the IRS standard Miles Rates is commonly applied, there are alternative methods for calculating mileage expenses:

- **Actual Expense Method:** This method allows you to deduct the real costs associated with operating your vehicle, such as gas, oil, repairs, and insurance. However, it requires detailed record-keeping and may be more complex to calculate.

- **Fixed Mileage Reimbursement:** Some businesses may establish their own fixed rate per mile for employee reimbursements, which can vary based on elements like vehicle type and local fuel prices.

Understanding mileage rates is crucial for anyone who uses a vehicle for business or personal purposes. By precisely tracking mileage and applying the right rates, you can optimize your finances, lower tax liabilities, and ensure fair compensation for travel expenses.